Aavas Loan - Home & MSME Loan

Description of Aavas Loan - Home & MSME Loan

Aavas Financiers Ltd, established in 2011, has disbursed over ₹20,000 crores, serving more than 2.5 lakh+ customers across 375 branches in 13 states. With a customer-centric approach and a unique appraisal methodology, Aavas is committed to empowering aspiring homeowners and building trust within underserved communities.

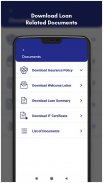

Using this app, you can apply for a new Home Loan / Loan against property (LAP) / MSME loan or manage your existing loan on the move anytime, anywhere and apply for a top-up loan!

- Check your loan details like EMI amount, next due date for EMI and apply for a top up loan!

- Check outstanding dues at any time and make payment via Debit Card, Net Banking or UPI in case of missed payment.

- Raise service request with Customer Support on your active loan and track status of service request!

- Find details of nearby Aavas branch and get directions!

- Refer new customers who are looking for Home Loan and help us grow the Aavas Family.

- Use the home loan EMI calculator to quickly calculate your EMI and understand your eligibility.

- Secure login with SIM verification/binding to avoid frauds.

Our Product Offerings:

✅ Home Loans for Purchase - We offer purchase loan for flat, house or bungalow from builders or development authorities as well as resale properties

✅ Purchase and Construction Loan - We provide finance for self-construction of residential house.

✅ Repair and Renovation Loan - Home Improvement Loan is one of the easiest ways to fund your dream of giving your home a new look and renovating it as per your desire.

✅ MSME Loan - An MSME business loan at a competitive interest rate can help in growing your business fast.

✅ Loans Against Property is a type of housing loan for leveraging your residential or commercial property to get the maximum finance against the market value of your property.

✅ Balance Transfer to transfer your existing home loan or loan against property to Aavas Financiers Limited or additional Top Up loan to existing loan at reasonable interest rates.

✅ Small Ticket Size Loan is extended for small amounts with short tenure and helps fulfil small financial needs upto Rs. 7.5 Lakhs. Besides that, it also offers a number of other benefits like speedy approval, easy process, flexible long tenure, competitive interest rates, easy EMI along with minimum paperwork, and fast online services.

📋 Loan Details:

Minimum Loan Tenure = 1 year

Maximum Loan Tenure = 30 years

Minimum Processing Fee = 2.5% of loan amount

Maximum Processing Fee = 3% of loan amount

Minimum Interest Rate = 9% per annum

Maximum Interest Rate = 24% per annum

Example of how Aavas Financiers Limited Home Loan works:

Let us assume - Home Loan Amount = ₹1,00,000, APR* (ROI) = 10% ,Loan Tenure = 10 Years

This will result in monthly EMI = ₹1,322

Total Interest Payable = ₹1,322 x 120 months - ₹1,00,000 = ₹58,581

Total Amount Payable (Principal + Interest) = ₹13,215 x 120 months = ₹1,58,581

Note:

1. The figures provided are for illustrative purposes only. The final Annual Percentage Rate will be determined based on the customer's credit evaluation.

2. Complete schedule of charge in 8 languages : https://www.aavas.in/schedule-of-charges

You may also stand to get income tax benefit on home loan under 24(b), 80EE, 80EEA and 80C of Income Tax Act of 1961.

Contact Us

1. Email: customercare@aavas.in

2. Website: https://www.aavas.in/contact-us

3. Address: Find your nearest branch https://www.aavas.in/contact-us

4. Registered Office: 201-202, 2nd Floor, Southend Square, Mansarover Industrial Area, Jaipur-302020